SEO matters for financial professionals because it tackles three challenges at once: visibility, credibility, and conversion.

First, you need to be visible in local search results when prospects type phrases like “wealth planner near me” or “investment consultant in Cardiff.”

Second, you must demonstrate authority and trustworthiness in a compliance-driven sector where consumer caution is high.

Third, your website must convert visitors into calls and booked appointments.

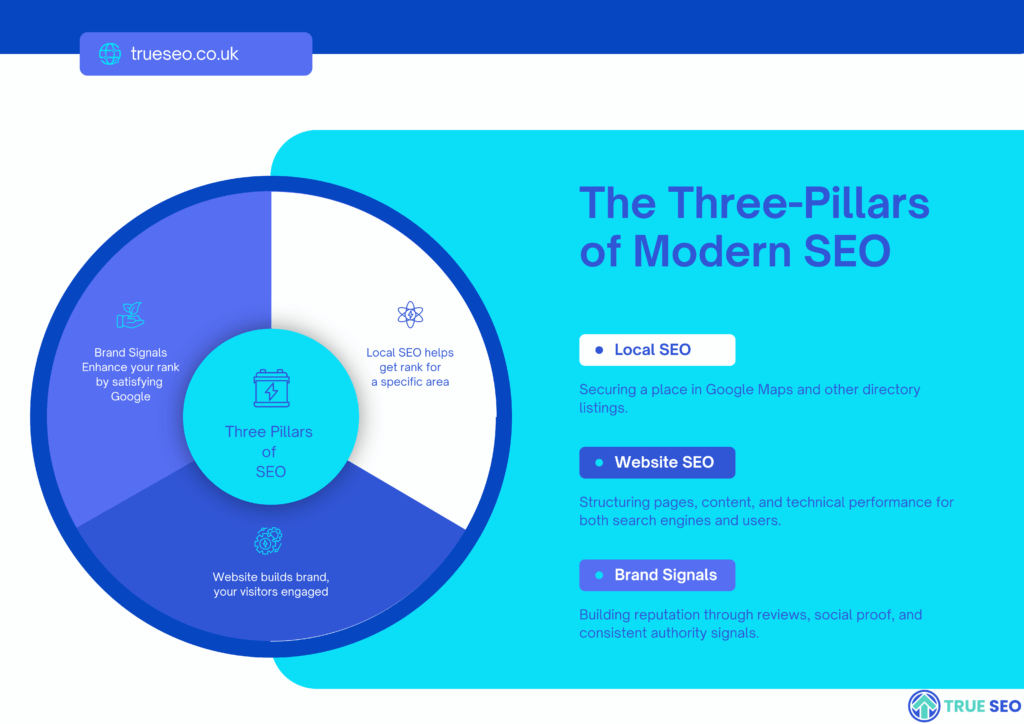

SEO success depends on mastering three pillars:

- Local SEO – securing a place in Google Maps and other directory listings.

- Website SEO – structuring pages, content, and technical performance for both search engines and users.

- Brand Signals – building reputation through reviews, social proof, and consistent authority signals.

The financial services industry brings unique challenges. High competition from large firms, strict Financial Conduct Authority (FCA) rules on promotions, and the complexity of financial products all make SEO harder. Yet those same factors create opportunity. Advisers who build transparent, authoritative, and compliant online profiles can stand out in their region and win clients consistently.

This guide explains exactly how financial advisers can rank higher, generate enquiries, and establish long-term trust.

Local SEO Foundations

What is local SEO for financial advisers and how does it attract nearby clients?

Local SEO ensures your firm appears when nearby prospects search for services like “pension advice near me” or “best financial consultant in Bristol.” These searches are highly valuable because people looking locally are usually ready to take action.

Local SEO helps accountants, wealth planners, and investment consultants position themselves in front of motivated prospects at the exact moment they are deciding who to contact.

Google reports that 76% of people who search for a local service visit a business within 24 hours, and 28% go on to book or buy. In financial services, where decisions carry high stakes, these are exactly the kind of clients you want to reach.

How can financial advisers optimise their Google Business Profile effectively?

A well-optimised Google Business Profile (GBP) is the backbone of local SEO. It determines whether you appear in the local Map Pack and Google Maps results.

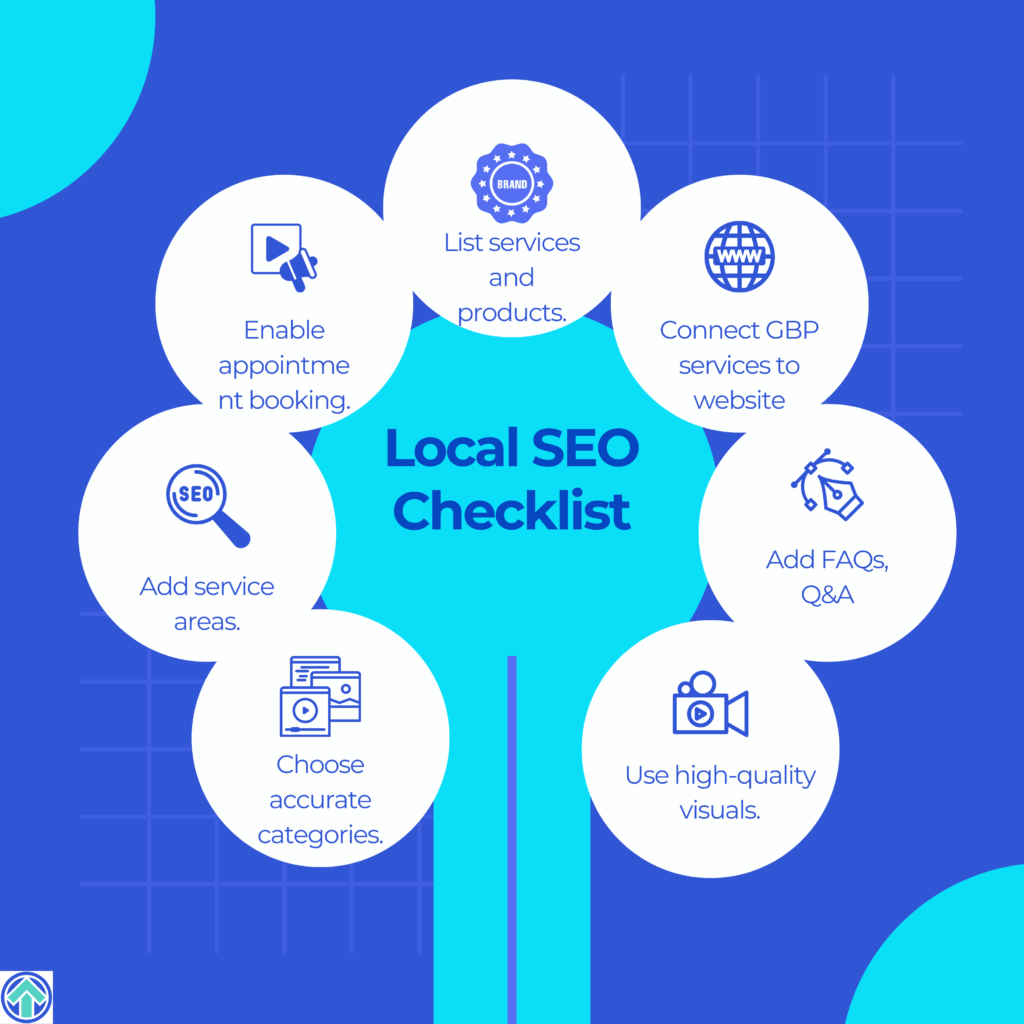

To optimise effectively:

- Choose accurate categories. Use Financial Consultant or Investment Service as the main category, and add relevant secondary categories like Wealth Management Service or Retirement Planning Service.

- Add service areas. List the towns, cities, and postcodes you cover — e.g., “Cardiff, Newport, Swansea” — to improve visibility for local searches.

- Enable appointment booking. Integrate online scheduling tools so prospects can book without delay.

- List services and products. Add specific offerings like “Inheritance Tax Planning,” “Pension Consolidation,” or “Business Exit Strategy.”

- Connect services to website pages. Link each GBP service to the matching service page on your site, improving both user experience and Google’s understanding of your content.

- Add FAQs. Populate your GBP with common questions clients ask, such as “Do you charge upfront fees?” or “Are you FCA regulated?” Provide clear, detailed, compliance-friendly answers.

- Answer Q&As thoroughly. When prospects ask questions, reply with context, not one-liners. For instance, instead of “Yes,” answer: “Yes, we provide inheritance tax planning advice, including use of allowances and exemptions tailored to your needs.”

- Publish regular updates. Post weekly or fortnightly updates about financial changes (e.g., new ISA limits, pension reforms), firm news, or events. Active profiles rank higher and build trust.

- Use high-quality visuals. Photos of your office, team, and events humanise your profile and boost clicks.

How do you rank higher on Google Business Profile (GBP)?

Getting into the top three “Map Pack” results requires ongoing optimisation. Core strategies include:

- NAP Consistency. Keep your Name, Address, and Phone identical across all directories, websites, and profiles.

- Keyword-rich descriptions. Use natural phrasing such as “Independent financial adviser in Bristol specialising in retirement income and tax efficiency.”

- Photos and media. Listings with photos receive 42% more direction requests and 35% more website clicks (Google).

- Reviews and engagement. Encourage client reviews and actively manage your GBP Q&A section.

- Citations and backlinks. List your firm on Yell, Thomson Local, and the FCA Directory. Build backlinks from local press, chambers of commerce, and professional partners.

- Behavioural signals. Google tracks how people interact with your profile (clicks, calls, directions). Higher engagement = higher rankings.

- Service-to-page linking. Connect each GBP service to a detailed landing page with case studies, FAQs, and a booking form.

- Consistent posting. Advisors posting weekly updates often rank above dormant profiles.

- Event promotion. Share webinars, workshops, or local events through GBP posts. These attract clicks and generate local mentions.

Why is Google Maps ranking critical for financial advisers?

Most clients will not travel far for initial meetings. Research shows over 60% of clicks in local searches go to the top three Map Pack results (Moz).

For advisers, this means if you’re not in the top three, competitors are getting those calls. Ranking high on Google Maps ensures that when someone within 5–10 miles searches for “pension advice” or “financial planner near me,” your firm is one of the first options.

What role do Bing Places and Apple Maps play in financial adviser visibility?

Google dominates, but Bing and Apple Maps matter too.

- Bing Places is widely used by older demographics, who are more likely to have assets and seek retirement planning. Many use Bing by default on Microsoft devices.

- Apple Maps powers searches on iPhones, iPads, and in-car systems like CarPlay. With Apple holding a major share of the UK smartphone market, advisers ignoring Apple Maps risk missing affluent, mobile-first clients.

Both platforms are free to claim and ensure you don’t lose visibility outside Google. Most of the time, you can import your Google My Business to Bing bu just clicking at the import button. Its easy!

How do reviews and ratings impact local SEO for financial advisers?

Reviews directly affect both ranking and trust. According to BrightLocal, 87% of people read online reviews for local services, and 79% trust them as much as personal recommendations.

For advisers, compliance is key. You cannot imply outcomes, but you can invite clients to share their service experience. A compliant example: “The adviser explained pension options clearly and helped me feel confident in my decisions.”

Strong strategies include:

- Encouraging steady review growth rather than sudden spikes.

- Monitoring sentiment to ensure reviews reflect professionalism and clarity.

- Responding to every review — showing you value client feedback.

What strategies build local authority with citations and backlinks?

Citations and backlinks confirm your legitimacy and boost rankings. Examples include:

- Business directories. Yell, Thomson Local, FCA Directory.

- Professional associations. Chartered Institute for Securities & Investment (CISI), Personal Finance Society (PFS).

- Local press. Provide commentary on tax changes or pensions to regional papers.

- Professional partnerships. Collaborate with accountants, solicitors, or mortgage brokers for cross-mentions.

- Community sponsorships. Support local charities or events and gain mentions in press or websites.

Combined with GBP optimisation, these strategies build a strong base of authority in local search.

Google needs to TRUST you as an EXPERT

We make it happen faster & Error-free

Website SEO for Financial Advisers

A strong Google Business Profile gets you discovered locally, but your website is where prospects decide to trust you.

For financial advisers, the website must achieve two goals at once: it needs to satisfy Google’s ranking requirements, and it must reassure visitors that you are compliant, credible, and worth contacting.

That’s why website SEO is not only about keywords, it is about structure, technical trust signals, and user experience that convert visits into booked consultations.

Which keywords should financial advisers target to win rankings?

The right keywords make the difference between a site that attracts random visitors and one that consistently brings in new clients. For financial professionals, the strongest opportunities lie in service + location combinations, such as:

- “Inheritance tax adviser in Manchester”

- “Pension consultant Cardiff”

- “Best investment planner in London”

These terms capture prospects with clear intent — people ready to contact someone local.

Equally important are long-tail and question-based searches. Examples include:

- “Who is the best retirement planning adviser in Bristol?”

- “How can I reduce inheritance tax on my UK property?”

- “Do I need a financial adviser for my pension?”

By targeting such queries, advisers align with how prospects naturally search, often through Google’s “People Also Ask” or voice searches.

At True SEO, our keyword research service identifies buyer-intent terms — not just high-volume words, but those with a stronger chance of converting to enquiries. For example, while “pension advice UK” is broad, “FCA regulated pension adviser Cardiff” targets motivated prospects with a high chance of booking a consultation.

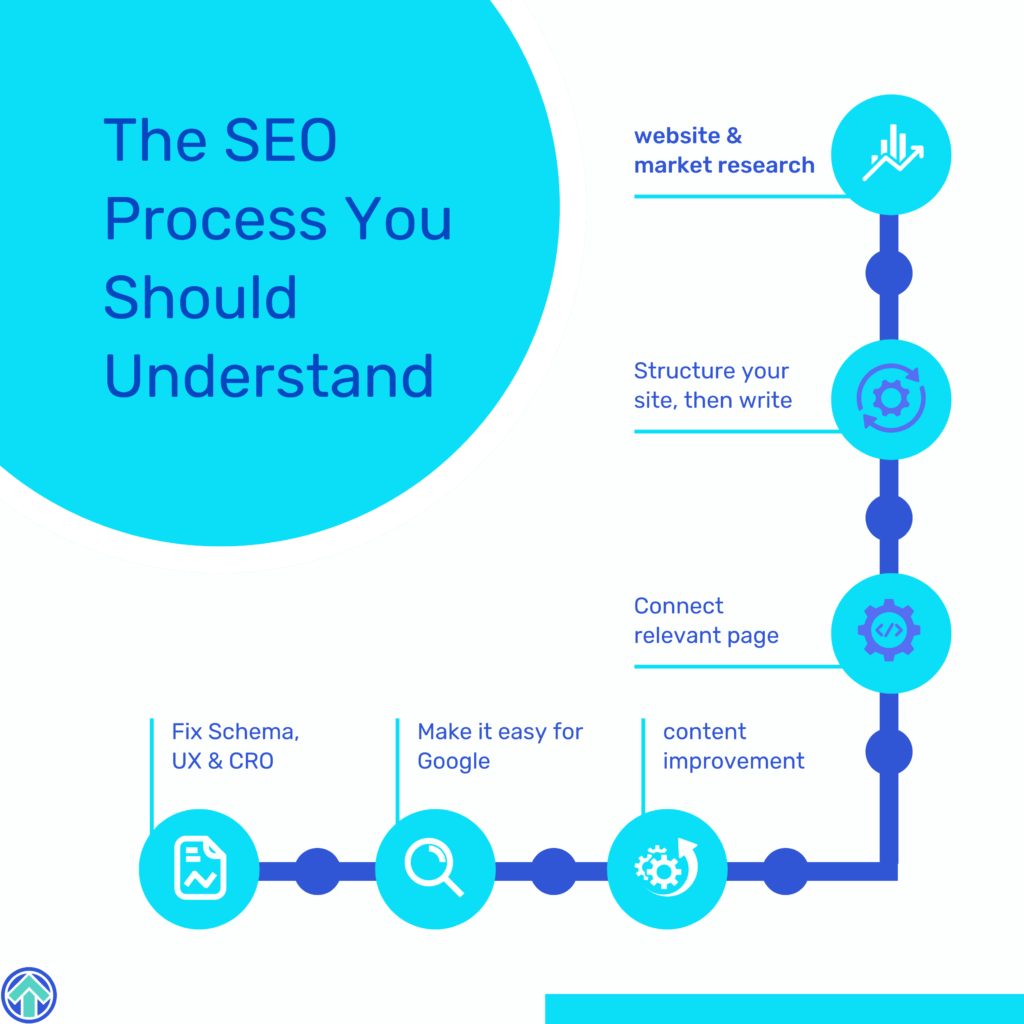

How should a financial adviser website be structured for SEO and conversions?

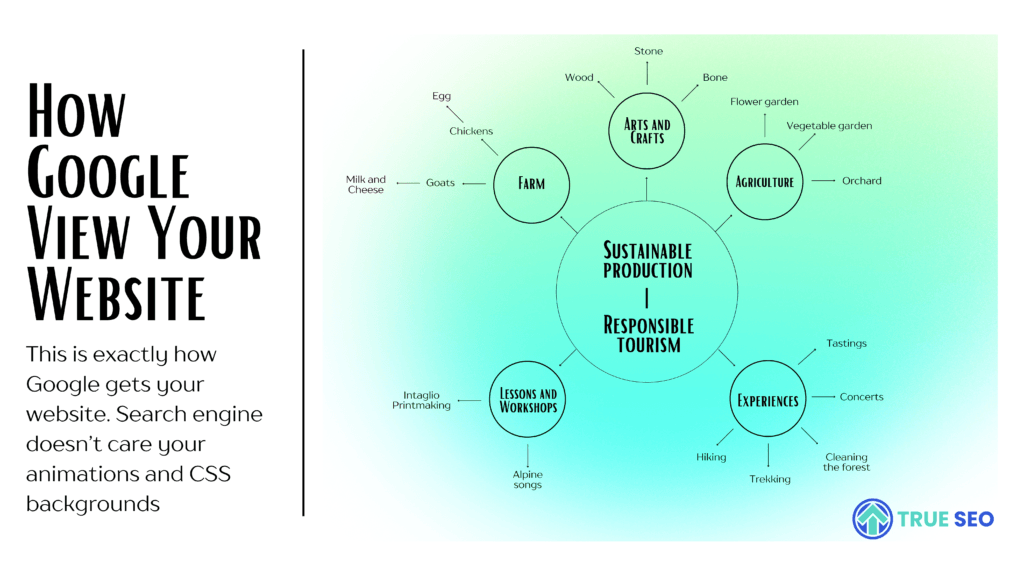

A website should be built to guide users as efficiently as possible from discovery to enquiry. A clear structure helps both Google and prospects understand what you offer.

Google loves a clearly understandable website as taking more time to read a website puts additional loads on resources at Google’s headquarter. The same applies for the other search engines as well.

Key elements of the website hierarchy include:

- Service Pages. Create dedicated pages for pensions, inheritance tax planning, wealth management, retirement income, and investments. Each page should explain the service, highlight benefits, and include a call to action.

- Location Pages. If you serve multiple towns or regions, use dedicated pages like “Inheritance Tax Planning in Newport” or “Retirement Planning in Cardiff.” These can include maps, local case studies, and directions.

- Calls to Action (CTAs). Strong CTAs such as “Book Your Free Consultation” should appear above the fold and be repeated throughout the page.

- Blog and Resources. Regular content — like “Top 5 ways to reduce inheritance tax in 2025” — attracts traffic and demonstrates authority.

- Compliance Notices. Display FCA registration numbers and compliance disclaimers (e.g., “Investments can go down as well as up”) clearly.

At True SEO, our web design service combines SEO with compliance-ready layouts. We design adviser websites that load fast, look professional, and funnel visitors to book calls without distractions.

Why is technical SEO essential for financial adviser websites?

Technical SEO ensures your site can be found, trusted, and indexed properly. Without it, even the best content will struggle to rank.

Essentials include:

- Mobile speed and responsiveness. Over 70% of local financial searches in the UK are mobile (Statista, 2024). A slow site means lost enquiries.

- Secure HTTPS. Security is critical for financial services. A “Not Secure” warning immediately deters prospects.

- Trust Badges. Display FCA registration, CISI or PFS memberships, and data protection logos to reassure visitors.

- XML Sitemap and Crawlability. Submit a sitemap in Google Search Console and ensure no important pages are blocked by robots.txt.

- Fast Hosting. UK-based hosting with a CDN ensures better local performance

How does schema markup improve financial adviser search performance?

Schema markup helps search engines interpret and display your content in rich results. Advisers should use:

- LocalBusiness + FinancialService Schema. Clarifies your location and service category.

- FAQ Schema. Displays questions and answers directly in search results, increasing clicks.

- Review Schema. When compliant, shows ratings beneath search listings to boost trust and visibility.

For example, an adviser in Birmingham optimising their pension service page with LocalBusiness and FAQ schema may see their Q&A appear directly under their Google listing, making it easier for prospects to choose them.

Schema tells the search engine who you are, what you do, and what’s best about you – in the search engine’s language.

How does conversion rate optimisation (CRO) turn visitors into clients?

Traffic alone doesn’t generate leads — CRO ensures visitors take the next step.

Proven CRO tactics for advisers include:

- Trust Badges. Prominently show FCA authorisation, memberships, and security certificates.

- Case Studies and Testimonials. Use anonymised stories like: “A business owner reduced inheritance tax exposure by £40,000 through structured gifting.” Always include disclaimers.

- Transparent Fees. Even if costs vary, explain your pricing model (fixed fee, percentage, or hourly) to build trust.

- Lead Generation Tools. Add live chat, chatbots, click-to-call, and online booking. Websites using chatbots increase lead capture by 67% (Drift research).

- Heatmaps and Testing. Tools like Hotjar show where users drop off. A/B testing landing pages improves enquiry rates over time.

This is my client’s website. It offers a clear structure both to search engines & visitors, and especially offers its visitors an easy, free 15-minute meeting option as well.

How does user experience (UX) influence SEO and lead generation?

User experience (UX) is crucial for both SEO and conversions. Google measures behaviour signals like time on page, and clients judge your credibility instantly.

Strong UX includes:

- Key content upfront. Show your value proposition, FCA registration, and CTA in the top section of every page.

- Chatbots and live chat. Provide 24/7 instant answers and lead capture.

- Visuals and infographics. Simplify complex topics with flowcharts, diagrams, and explainer videos.

- Clear CTAs. Use consistent, visible action buttons throughout the site.

- Mobile-first design. Ensure menus, forms, and buttons are easy to use on small screens.

At True SEO, our web design integrates these UX principles so your site doesn’t just rank — it converts visitors into enquiries.

What role does content marketing play in SEO for financial advisers?

Content is where advisers prove authority. Clients making financial decisions need education and reassurance, which well-structured content provides.

Effective strategies include:

- Educational Blogs. Posts like “5 strategies to reduce inheritance tax in 2025” answer questions and capture search demand.

- Evergreen Guides. Resources like “Understanding ISA allowances in the UK” stay relevant year after year.

- Local Case Studies. Real-life examples resonate strongly, e.g., “How a Newport couple cut their inheritance tax liability by £40,000.”

- Explainer Videos. Short clips clarifying pension transfers or investment risks can be embedded in blogs and shared socially.

- Downloadable Guides. Lead magnets like “The Complete Guide to Retirement Planning in the UK” help capture emails for follow-up.

At True SEO, we take content further with our topical map service. Instead of publishing random blogs, we create interconnected content clusters around your services. For example, a pensions service page would be supported by articles on pension transfers, annuity vs drawdown, and auto-enrolment rules. This builds topical authority, making Google view your firm as the go-to source in your niche.

90-day plan to RANK A NICHE WEBSITE

We encourage DIY SEO with our Niche Marketing Blueprint, which combines 15 years of SEO expertise.

Delivered in 7 Days

Social Media Marketing and Brand Signals

Even the best-optimised website and Google profile need brand signals to reinforce credibility. Social media does not directly change Google rankings, but it shapes how people talk about your firm online.

Website rank comes from the historic data (clicks + impressions). Social media, in that case, sends positive impressions to the search engine with some extra clicks & visitors’ engagement.

When prospects share your content, leave reviews, and engage with your posts, it strengthens your reputation — which in turn builds trust with both clients and search engines. For financial advisers, accountants, and business coaches, social platforms are often where authority is demonstrated and credibility is tested.

Why does social media matter for SEO in financial services?

Social media does not directly alter Google rankings, but it strongly influences brand signals — the trust, authority, and awareness factors search engines use when ranking businesses. When people share your content, engage with your posts, or search directly for your firm’s name, it signals credibility.

For financial advisers, coaches, and accountants, social media bridges visibility and trust. A LinkedIn article explaining inheritance tax updates may not immediately rank you higher, but if it drives traffic, earns backlinks, and increases brand searches, it strengthens your overall SEO.

The FCA’s Financial Lives Survey shows that 38% of UK adults look for financial information online before contacting an adviser. Many of these initial touchpoints now happen on social media, making it an essential part of your SEO funnel.

Which platforms should financial advisers focus on for visibility and trust?

Not every platform delivers equal results. Advisers should carefully choose where to build authority, based on where their clients spend time.

- LinkedIn. The most effective platform for authority in financial services. Publishing insights on tax efficiency, pension planning, or regulatory changes positions you as a trusted professional. It is also the best channel for B2B referrals — particularly relevant to accountants and business coaches.

- Facebook. Still valuable for local engagement, especially through community groups and targeted ads. Financial coaches and planners can reach families or retirees by targeting age, location, and income.

- YouTube. Educational video content attracts both search and social audiences. Simple explainers like “How UK inheritance tax works” or “5 common pension mistakes” perform well and can be repurposed for blogs and client resources.

- Twitter (X). Useful for commentary on budgets, economic updates, or regulatory changes. This builds credibility among peers, journalists, and professionals following financial news.

A strong case study comes from Reza Hooda, a Virtual CFO specialist who runs two firms: The Profitable Accountants Community (targeted at accounting firms) and Capture Accounting (focused on freelancers). Instead of promoting both in the same place, he identified where each audience is active. His accountants’ community thrives on LinkedIn, where professionals seek peer-to-peer insights. Meanwhile, his freelancer brand gains traction on TikTok, Instagram, and Facebook, where creatives and self-employed individuals spend time.

This highlights a key principle: advisers must understand where their audience is before investing time in content. A wealth planner working with business owners may gain better reach on LinkedIn, while a coach supporting freelancers may achieve higher engagement on Instagram or TikTok.

How can social media content amplify financial adviser SEO?

Social media amplifies your SEO by distributing content more widely, creating backlinks, and encouraging engagement.

Effective strategies include:

- Repurposing blog content. A long article on inheritance tax planning can be shared as a LinkedIn post, a Facebook infographic, and a short YouTube Q&A.

- Video testimonials and webinars. FCA-compliant client feedback and expert webinars build social proof. Recordings can be turned into blog embeds, YouTube content, and email campaigns.

- Infographics and quick tips. Visual assets simplify complex concepts such as ISA rules or pension allowances, increasing shareability.

- Traffic-driving posts. Every post should link back to your website. For instance, a LinkedIn article on tax-free allowances should point directly to your inheritance tax service page.

When you share a blog post on LinkedIn, it is part of a structured ecosystem that builds topical authority across entire subjects — pensions, tax planning, estate management — ensuring social shares also strengthen SEO rankings.

What role does reputation management play in building brand trust online?

Reputation management ensures that your online image supports both SEO and client trust. In financial services, reputation is everything.

Key actions include:

- Monitoring mentions. Use alerts to track brand references and respond quickly to negative or misleading content.

- Review management. Encourage Google and Facebook reviews, and respond to each one professionally. Prospects often read responses more carefully than the reviews themselves.

- Consistent NAP details. Your business name, address, and phone number should match across all profiles and your website. Inconsistencies harm both rankings and credibility.

- Showcasing authority. Publish FCA registration numbers, highlight professional memberships, and share compliance-friendly testimonials across your profiles.

At True SEO, we support advisers with brand optimisation services. We ensure your website, Google profile, and social channels reinforce one another. When people consistently engage with your brand name across platforms, Google recognises these signals — boosting your rankings and authority over time.

What compliance rules shape SEO strategies for UK financial advisers?

Compliance is the backbone of all marketing in financial services. The Financial Conduct Authority (FCA) requires content to be clear, fair, and not misleading. This shapes everything from website copy to Google Business Profile updates.

- Meta descriptions and titles. Avoid exaggerated claims like “guaranteed pension growth.” Instead, use factual wording: “Independent FCA-regulated advice on pensions and investments.”

- Testimonials and reviews. Allowed, but must include disclaimers such as “Past performance is not a guide to future results.”

- Blog and GBP posts. Frame content around education — e.g., “How inheritance tax thresholds work in 2025” — not promises of financial outcomes.

- Calls to action. Compliance allows invitations like “Book a consultation with an FCA-authorised adviser” but discourages sales-heavy language like “Maximise your wealth today.”

How does E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) affect rankings?

Financial content falls under Google’s Your Money or Your Life (YMYL) category, meaning the quality bar is higher. Google expects advisers to demonstrate E-E-A-T:

- Experience. Publish anonymised case studies such as “A Cardiff couple reduced inheritance tax exposure through structured gifting.”

- Expertise. Showcase adviser bios, qualifications (Chartered Financial Planner), and professional memberships (CISI, PFS).

- Authoritativeness. Secure mentions in trusted outlets like regional press or professional associations.

- Trustworthiness. Display FCA registration numbers, disclaimers, transparent fees, and client care policies.

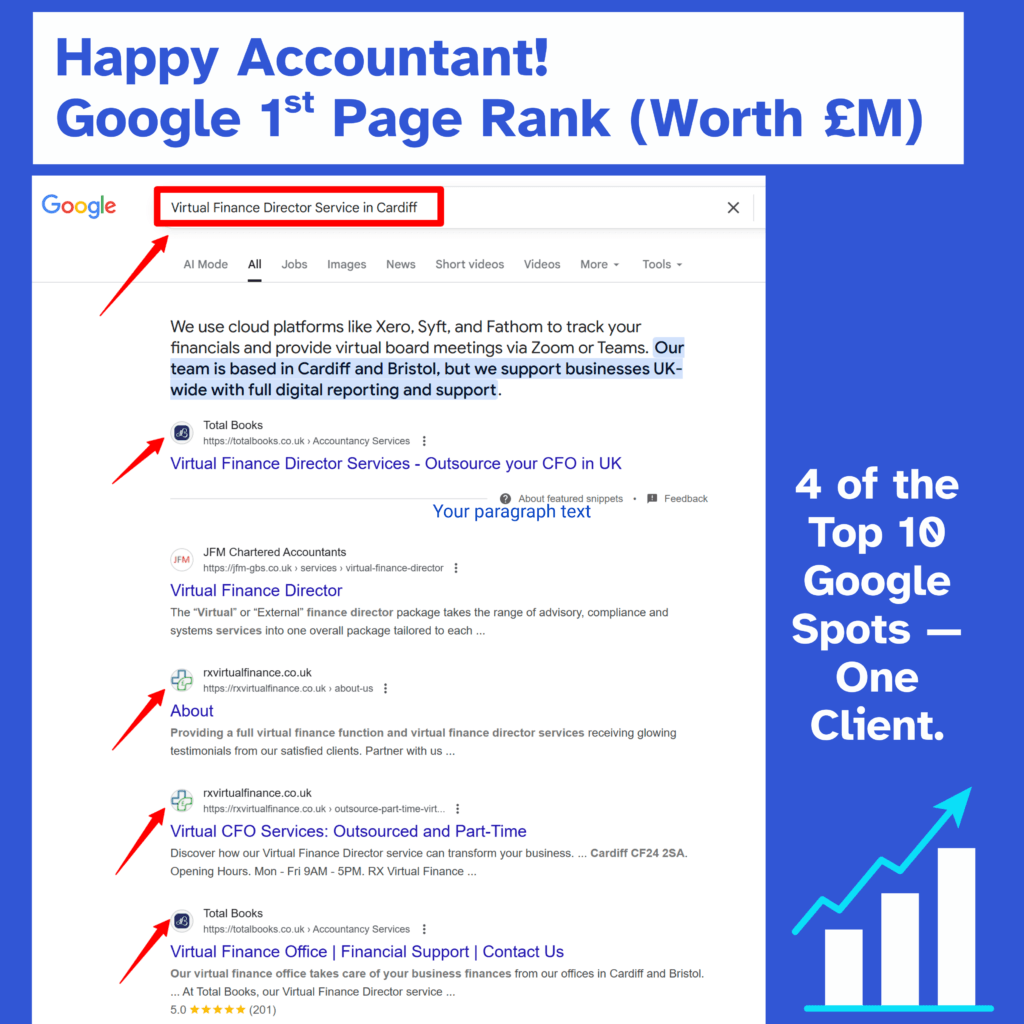

Have a look at the picture below, we ranked our accountancy practice client for highly competitive keywords that demonstrate strong EEAT signals from Google.

Why is voice search relevant for financial advisers in 2025?

Voice search is changing how clients look for advisers. Increasingly, prospects use conversational queries via smart speakers and mobiles:

- “Best financial adviser near me.”

- “Who can help me transfer my pension in Cardiff?”

- “How much inheritance tax will I pay on my property?”

To capture this traffic:

- Create FAQ sections with conversational questions and answers.

- Use natural keywords such as “who,” “how,” “where.”

- Ensure GBP is optimised for “near me” searches with service areas and reviews.

Blogs like “Do I need a financial adviser for my ISA?” or “Who is the best retirement planner in Cardiff?” also align perfectly with voice queries.

How can financial advisers track and measure SEO success effectively?

Without measurement, SEO is just guesswork. Advisers need clear tracking to prove ROI:

- Google Analytics 4 (GA4). Track traffic, engagement, and form submissions.

- Conversion tracking. Monitor enquiries through forms, live chat, and booking systems.

- Call tracking. Attribute phone enquiries to specific campaigns or pages.

- CRM integration. Connect lead sources to client outcomes for accurate ROI reporting.

- Rank tracking. Monitor local rankings for terms like “pension adviser Cardiff” to measure progress.

What long-term SEO strategies build lasting authority and trust?

SEO in financial services must be sustainable. The most effective long-term strategies include:

- Evergreen content. Guides like “ISA rules explained” or “Estate planning in the UK” attract ongoing traffic and can be refreshed annually.

- PR mentions and partnerships. Collaborating with solicitors, accountants, or local business groups generates natural backlinks and authority.

- Local sponsorships. Supporting charities or events builds trust and earns coverage in local press.

- Knowledge Graph optimisation. Consistently use structured data, FCA registration, and service entities so Google recognises your firm as an authority.

- AI-driven search readiness. With Google SGE and Bing AI evolving, advisers who publish structured topical clusters around pensions, inheritance tax, and wealth planning will dominate personalised search results.

Financial advisers, accountants, and wealth consultants who want to grow cannot rely on referrals alone. Clients increasingly begin their search online, and the firms that rank higher, look credible, and provide an easy path to contact are the ones that win those enquiries.